Fundamental Payroll Certification

Last Update 2 weeks ago

Total Questions : 145

Fundamental Payroll Certification is stable now with all latest exam questions are added 2 weeks ago. Incorporating FPC-Remote practice exam questions into your study plan is more than just a preparation strategy.

FPC-Remote exam questions often include scenarios and problem-solving exercises that mirror real-world challenges. Working through FPC-Remote dumps allows you to practice pacing yourself, ensuring that you can complete all Fundamental Payroll Certification practice test within the allotted time frame.

When testing a payroll business continuity plan, all of the following tasks are critical to issuing payments to employees EXCEPT:

A willful violation of child labor laws, that does NOT involve serious harm or death, can result in a fine of up to:

When providing wage data for a workers’ compensation audit, which of the following wage types would be included as compensation?

Which of the following forms of identification CANNOT be used in Section 2 of Form I-9?

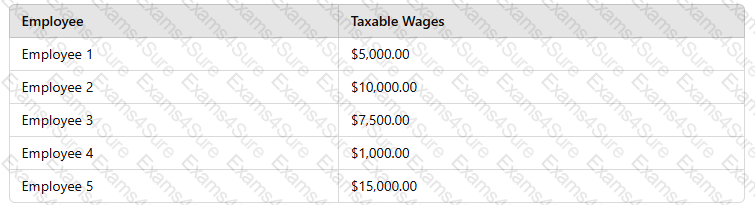

Using the table of taxable wages below, calculate the employer'sFICA tax liabilityon the first check of the year:

When a payer receives a “B” Notice, it must send a copy of the notification to the payee within:

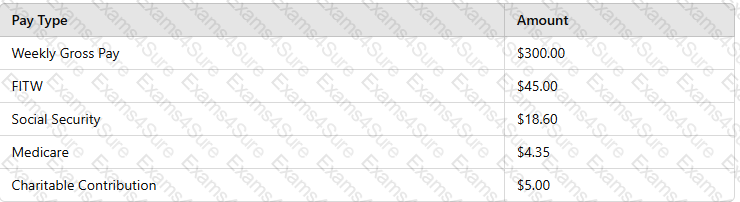

Under theCCPA, use the following information to calculate theMAXIMUMdeduction for the child support order for an employee whois not supporting another family and not in arrears.

TESTED 14 Mar 2025

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.