Certified Credit Research Analyst Level 2

Last Update 2 months ago

Total Questions : 84

Certified Credit Research Analyst Level 2 is stable now with all latest exam questions are added 2 months ago. Incorporating CCRA-L2 practice exam questions into your study plan is more than just a preparation strategy.

CCRA-L2 exam questions often include scenarios and problem-solving exercises that mirror real-world challenges. Working through CCRA-L2 dumps allows you to practice pacing yourself, ensuring that you can complete all Certified Credit Research Analyst Level 2 practice test within the allotted time frame.

Proportion of fee based income is examined as the same is an _____ efficient source of bank’s profitability.

Satish Dhawan, a veteran fixed income trader is conducting interviews for the post of a junior fixed income trader. He interviewed four candidates Adam, Balkrishnan, Catherine and Deepak and following are the answers to his questions.

Question 1: Tell something about Option Adjusted Spread

Adam: OAS is applicable only to bond which do not have any options attached to it. It is for the plain bonds.

Balkishna: In bonds with embedded options, AS reflects not only the credit risk but also reflects prepayment risk over and above the benchmark.

Catherine: Sincespreads are calculated to know the level of credit risk in the bound, OAS is difference between in the Z spread and price of a call option for a callable bond.

Deepark: For callable bond OAS will be lower than Z Spread.

Question 2: This is a spread that must be added to the benchmark zero rate curve in a parallel shift so that the sum of the risky bond’s discounted cash flows equals its current market price. Which Spread I am talkingabout?

Adam: Z Spread

Balkrishna: Nominal Spread

Catherine: Option Adjusted Spread

Deepark: Asset Swap Spread

Question 3: What do you know about Interpolated spread and yield spread?

Adam: Yield spread is the difference between the YTM of a risky bond and the YTM of an on-the-run treasury benchmark bond whose maturity is closest, but not identical to that of risky bond. Interpolated spread is the spread between the YTM of risky bond and the YTM of same maturity treasury benchmark, which is interpolated from the two nearest on-the-run treasury securities.

Balkrishna: Interpolated spread is preferred to yield spread because the latter has the maturity mismatch, which leads to error if the yield curve is not flat and the benchmark security changes over time, leading to inconsistency.

Catherine: Interpolated spread takes account the shape of the benchmark yield curve and therefore better

than yield spread.

Deepak: Both Interpolated Spread and Yield Spread rely on YTM which suffers from drawbacks and inconsistencies such as the assumption of flat yield curve and reinvestment at YTM itself.

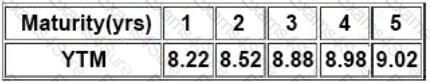

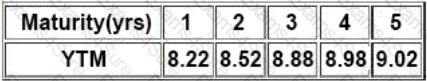

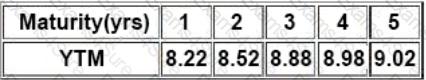

Then Satish gave following information related to the benchmark YTMs:

There is a 10.25% risky bond with a maturity of 4.75 year(s). Its current price is INR105.31, which corresponds

to YTM of 9.22%. Compute Interpolated Spread from the information provided in the vignette:

For considering the assignment of probabilities, which of the following aspects are taken into account?

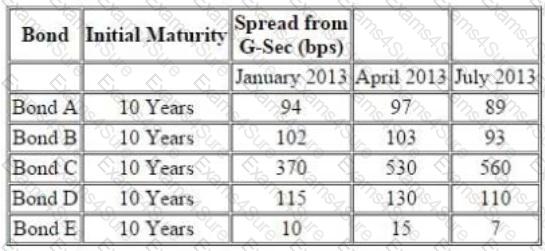

The following information pertains to bonds:

Further following information is available about a particular bond ‘Bond F’

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which ccorresponds to YTM of 9.22%. The following are the benchmark YTMs.

Assume that the general market rates have increased. An issuer, Revolution Ltd has plans to roll over its existing commercial paper and forth coming reset dates for its floating rate bonds are very near. Which of the following ratios for revolution will get impacted?

The following information pertains to bonds:

Further following information is available about a particular bond ‘Bond F’

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

From the time January 2013 to April 2013, what can you predict about the market conditions, assuming the GSec has not changed?

Mark Construction Company (MCC) has bagged a contract for construction of a large dam and hydro power project on river Shivna in Madhya Pradesh (MP). The project is also of relevance from the irrigation perspective due to its location and as per the agreement MCC will have to undertake construction of web of canals, approach road to dam, power house and other ancillary units. MCC is promoted by Mr. Thomas Mark, who is a MP from the ruling party which recently formed government in MP. Historically, MCC has been engaged into construction of rural roads, small bridges and railway platforms on contract basis for the Government. MCC will have a separate special purpose vehicle (SPV) floated for this venture.

The hydro power project comes under the public private partnership scheme of the Government of MP, where in the private partner builds owns operates and transfers (BOOT) the hydro power plant. The detailed terms of the hydro power project agreement are as follows:

1. The construction of the dam, canals and hydro power plant shall be undertaken by the contractor. The

Government of MP will have to acquire land which will submerge on construction of dam and shall rehabilitate the owners of land.

2. MCC shall have right to operate the hydro power project from date of commencement of commercial operations (DCCO) for a period of 20 years and shall transfer the project to Government thereafter. Further,

SPV shall be tax exempt for a period of five years from DCCO i.e. FY17-FY21.

3. The power project is of 600 megawatts (MW) shall comprise 4 units of 150 MW each. The estimated cost of project is about INR3, 500 Million to be spent over a period of 4 year(s) the project is estimated to be commercially operational by April 1, 2016 with two units operational om same day and one unit each will be operational on April 1, 2017 and April 1, 2018.

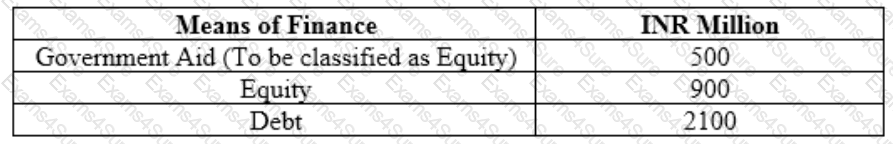

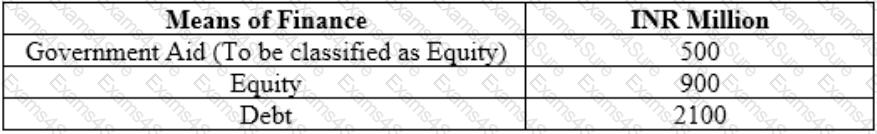

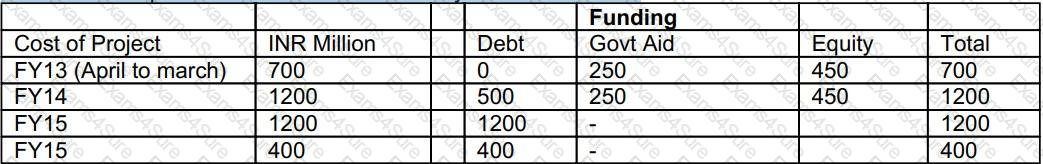

4. Means of finance:

Means of Finance INR Million

Government Aid (To be classified as Equity) 500Equity 900 Debt 2100

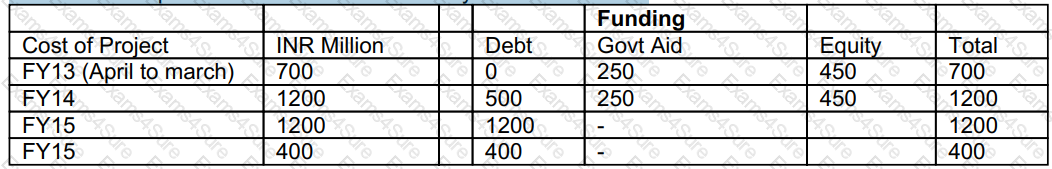

5. Amount if expenditure estimated in various years is as follows:

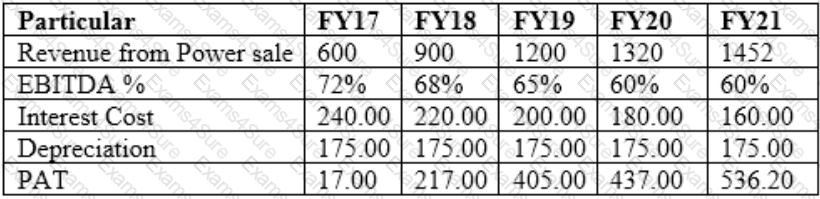

Debt shall bear a fixed rate of interest of 10% and all interest till DCCO shall be added to the principal. The expected principal along with capitalized interest is expected to be INR2, 400 Million (i.e.INR2100 Million debtplus INR300 Million capitalized interest). The repayment of the same shall be in 12 equated annual installments starting from FY17.

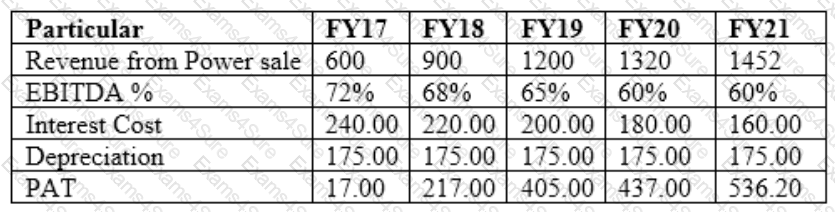

Brief projections for the period of FY17 to FY21 are given below:

Developments as on March 31, 2015

The project manager for the SPV made following comments at a press conferee on March 31, 2015:

As you all are aware, we were running bang on schedule till we last met on December 21, 2014. From today we are just left with one more year to complete the project in time. However, the flash floods which struck our dam site on this March 15, 2015 have created havoc in the region. I shall not point out the loss of lives in the region as you all are well aware of those. Our project has also been badly hit due to the same and we have been assessing the damage over the last one week. After analyzing damage, we have made changes in project schedule. Now we will be making only one unit of 150 MW operational on April 1, 2016 and 1 unit each will be added in each of subsequent year(s).

Development as on September 30, 2015

Post the flash floods, lot of environmentalists started raising issues of changes in environment due to construction of large number of dams. A few Public Interest Litigations (PILs) have been filed in various courts.

Honorable High Court of MP on September 27, 2015, banned construction of any dams in the region and banned permissions for new dams till next hearing scheduled on November 30, 2015. MCC in its press release has indicated that they will apply to the higher court on the matter.

As a credit rating analyst on September 30, 2015, on receipt of the high court order, what rating action you will take:

Mark Construction Company (MCC) has bagged a contract for construction of a large dam and hydro power project on river Shivna in Madhya Pradesh (MP). The project is also of relevance from the irrigation perspective due to its location and as per the agreement MCC will have to undertake construction of web of canals, approach road to dam, power house and other ancillary units. MCC is promoted by Mr. Thomas Mark, who is a MP from the ruling party which recently formed government in MP. Historically, MCC has been engaged into construction of rural roads, small bridges and railway platforms on contract basis for the Government. MCC will have a separate special purpose vehicle (SPV) floated for this venture.

The hydro power project comes under the public private partnership scheme of the Government of MP, where in the private partner builds owns operates and transfers (BOOT) the hydro power plant. The detailed terms of the hydro power project agreement are as follows:

1. The construction of the dam, canals and hydro power plant shall be undertaken by the contractor. The

Government of MP will have to acquire land which will submerge on construction of dam and shall rehabilitate the owners of land.

2. MCC shall have right to operate the hydro power project from date of commencement of commercial operations (DCCO) for a period of 20 years and shall transfer the project to Government thereafter. Further,

SPV shall be tax exempt for a period of five years from DCCO i.e. FY17-FY21.

3. The power project is of 600 megawatts (MW) shall comprise 4 units of 150 MW each. The estimated cost of project is about INR3, 500 Million to be spent over a period of 4 year(s) the project is estimated to be commercially operational by April 1, 2016 with two units operational on same day and one unit each will be operational on April 1, 2017 and April 1, 2018.

4. Means of finance:

Means of Finance INR Million

Government Aid (To be classified as Equity) 500Equity 900 Debt 2100

5. Amount if expenditure estimated in various years is as follows:

Debt shall bear a fixed rate of interest of 10% and all interest till DCCO shall be added to the principal. The expected principal along with capitalized interest is expected to be INR2, 400 Million (i.e.INR2100 Million debt plus INR300 Million capitalized interest). The repayment of the same shall be in 12 equated annual installments starting from FY17.

Brief projections for the period of FY17 to FY21 are given below:

Developments as on March 31, 2015

The project manager for the SPV made following comments at a press conferee on March 31, 2015:

As you all are aware, we were running bang on schedule till we last met on December 21, 2014. From today we are just left with one more year to complete the project in time. However, the flash floods which struck our dam site on this March 15, 2015 have created havoc in the region. I shall not point out the loss of lives in the region as you all are well aware of those. Our project has also been badly hit due to the same and we have been assessing the damage over the last one week. After analyzing damage, we have made changes in project schedule. Now we will be making only one unit of 150 MW operational on April 1, 2016 and 1 unit each will be added in each of subsequent year(s).

Development as on September 30, 2015

Post the flash floods, lot of environmentalists started raising issues of changes in environment due to construction of large number of dams. A few Public Interest Litigations (PILs) have been filed in various courts.

Honorable High Court of MP on September 27, 2015, banned construction of any dams in the region and banned permissions for new dams till next hearing scheduled on November 30, 2015. MCC in its press release has indicated that they will apply to the higher court on the matter.

As a credit analyst on March 31, 2012, which of the following sets of risks are you going to put in your credit appraisal note?

TESTED 31 Mar 2025

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.