Pega Certified Decisioning Consultant (PCDC) version 8.5

Last Update 2 months ago

Total Questions : 60

Pega Certified Decisioning Consultant (PCDC) version 8.5 is stable now with all latest exam questions are added 2 months ago. Incorporating PEGAPCDC85V1 practice exam questions into your study plan is more than just a preparation strategy.

PEGAPCDC85V1 exam questions often include scenarios and problem-solving exercises that mirror real-world challenges. Working through PEGAPCDC85V1 dumps allows you to practice pacing yourself, ensuring that you can complete all Pega Certified Decisioning Consultant (PCDC) version 8.5 practice test within the allotted time frame.

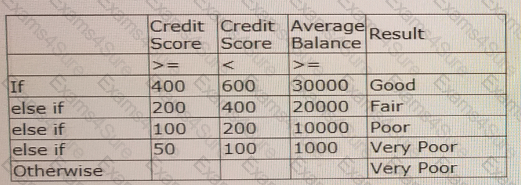

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

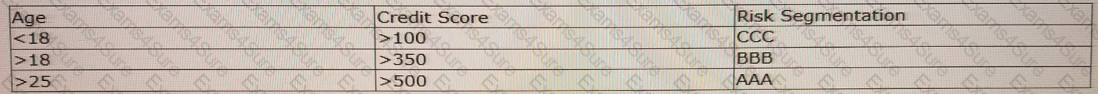

U+ Bank wants to offer credit cards only to customers with a low-risk profile. The customers are divided into various risk segments from AAA to CC

C.

The risk segmentation rules that the business provides use the Age and the customer Credit Score based on the following table. The bank uses a scorecard model to determine the customer Credit Score.

As a decisioning consultant, how do you implement the business requirement?

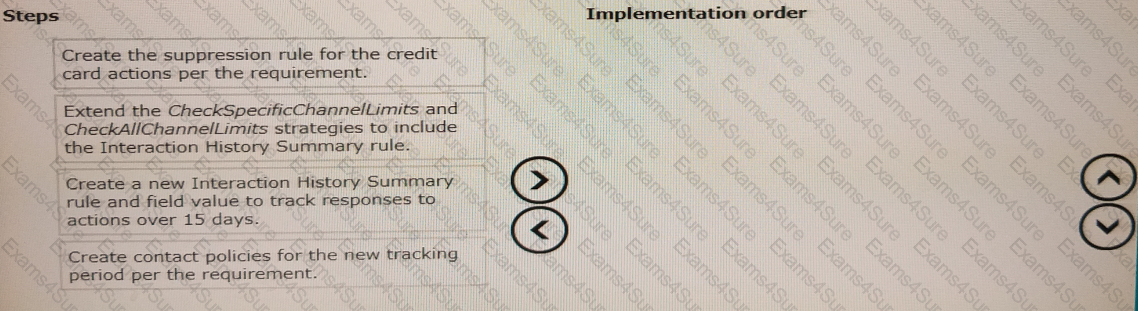

A financial institution wants to add a new tracking period to track its customers' response over 15 days in various channels. Once the response is tracked, they want to suppress the credit card actions if customers ignore it three times within 15 days.

Put the steps in the correct order to implement this task.

Using Pega Customer Decision Hub, a mobile company transitions from a one-to-many to a one-to-one marketing approach. The company is introducing a new data plan.

Which two channels can the company use to present the new data plan to a customer? (Choose Two)

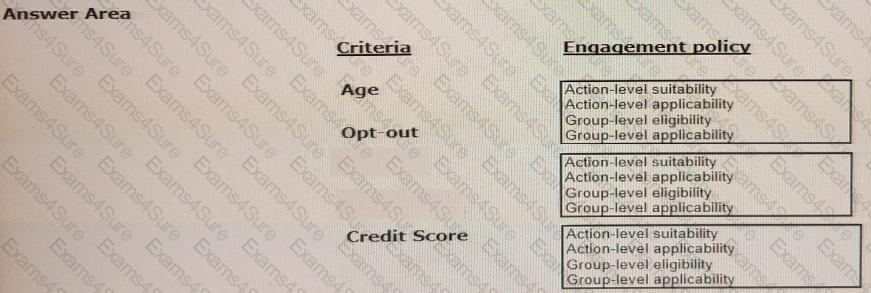

U+ Bank, a retail bank, has introduced a credit cards group with Gold card and Platinum card offers. The bank wants to present these two offers based on the following criteria:

1. For both cards, customers must be above the age of 18

2. Offer both cards only if the customer does not explicitly opt-out of any direct marketing for credit cards

3. Platinum card is suitable for customers with the Credit Score > 500

As a decisioning consultant, how do you implement this requirement? In the Answer Area, select the correct engagement policy for each criterion.

U+ Bank has recently introduced a few mortgage offers that are presented to qualified customers on its website. The business now wants to prevent offer overexposure, as overexposure negatively impacts the customer experience.

Select the correct suppression rule for the requirement: If a customer is presented on the website with the same offer five times in the last 14 days, do not show the same offer to that customer for the next 10 days.

U+ Bank has recently started using Pega Customer Decision Hub™ to display the first credit card offer, the Standard card, to every customer who logs in to their website.

Which three tasks do you need to perform to implement this requirement? (Choose Three)

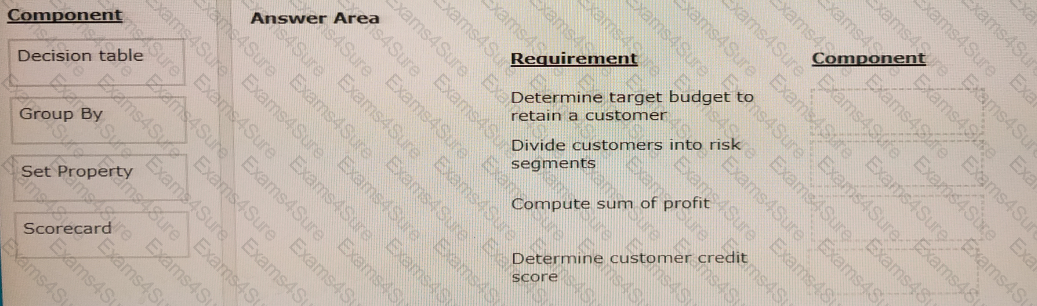

You are a strategy designer on a next-best-action project and are responsible for designing and implementing decision strategies.

Select each component on the left and drag it to the correct requirement on the right.

The U+ Bank marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want customers to receive more than four promotional emails per quarter, regardless of past responses to that action by the customer.

Which option allows you to implement the business requirement?

TESTED 31 Mar 2025

Hi this is Romona Kearns from Holland and I would like to tell you that I passed my exam with the use of exams4sure dumps. I got same questions in my exam that I prepared from your test engine software. I will recommend your site to all my friends for sure.

Our all material is important and it will be handy for you. If you have short time for exam so, we are sure with the use of it you will pass it easily with good marks. If you will not pass so, you could feel free to claim your refund. We will give 100% money back guarantee if our customers will not satisfy with our products.